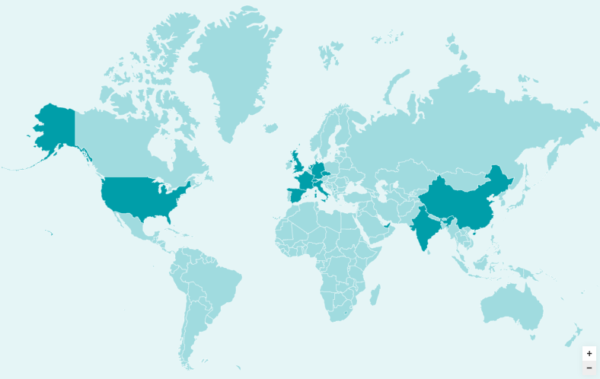

ICFG member firms specialize in serving the merger, acquisition, divestiture, and financing needs of middle-market clients around the globe.

ICFG Germany provided full support to JACOB Elektronik GmbH in the implementation of a succession strategy

JACOB Elektronik GmbH